We're a fund that champions outlier entrepreneurs using technology to solve the world's biggest problems

Minimum Viable Fund is a pre-seed, prototype stage fund and syndicate partnering with deep tech, brand-focused companies dedicated to turning industries on their heads. We have a sweet spot for super early stage founders with scientific insights and customer understanding that transforms convention (PhD not necessary!)We invest as early as possible and enjoy iterating through product, positioning and technology strategy from day 1.If you're building something ambitious, reach out.

Investing

We can and do invest at idea stage, backing founders from any background who we believe can build their idea.

MVF Fund I is a first money fund and venture programme providing our Deep Tech toolkit, available for the first time to founders outside of the university. We fund prototype and idea stage founders and PhD students to build and validate their businessEvery year we invest between £50,000-150,000 in up to 20 super early-stage startups each year using the latest in deep tech and biotech to build great products and businesses that solve real world problems.

The MVF Syndicate a thesis driven community investing in established ideas as a co-investor for pre-seed and seed rounds in companies that are taking on the world's most challenging problems by delving into the cutting-edge of biology and engineering.

What sort of companies do we mean and what do we believe in?

We're mostly interested in companies addressing the biggest, most polluting or complicated and old fashioned industries we know.More broadly, we love companies that are in the biotech, life science and bio-economy space (is there a better catch-all term? If so, please let us know here!) which recognise that we need new solutions fast, and are prepared to use new tools and technologies to get things doneWe love companies that are in the unlikeliest of places doing blue sky thinking, and are positioned in the right place for growth.

What industries are you most excited about?

We're biotech, engineering, data and life science experts who think that the industry is transforming the way tech did, from high upfront costs to a world of platform technologies and enabling services, creating a "build anywhere, launch anywhere" model where less and less money is needed to validate and launch. We call this Bootstrap Biotech

Wetware 💧Novel organisms, new chemicals, enzymes, the squishy stuff in between is what is eating traditional manufacturing.Through "wet" science we can replace meat, fix soils, build new materials, diagnose disease, and develop renewable feedstocks.It's never been easier to engineer an organism to do what what you want.

Hardware ⚒️Hardware -is- hard, but most of the things around you are tangibleWe're not the first, or the last, to recognise hardware + scale + tech is a strong defensible offering.We need hardware to change the world.

Impact 💥Our industries are fundamentally consumptive, and carbon is just the first resource to feel the squeeze. The best new technologies will help us reduce waste, utilise new resources, replace current systems, or reduce the water, energy, soil, raw material, etc etc needed to make our lives better.

Scalability ⚖️Scale is the difference between impact and no change. This has been done in tech so easily thanks to the marginal cost of reproduction in software.Now software is rescuing biotech. Robotics, automation, and analytics are making time to market shorter, and team sizes smaller.

Funding for the outliers

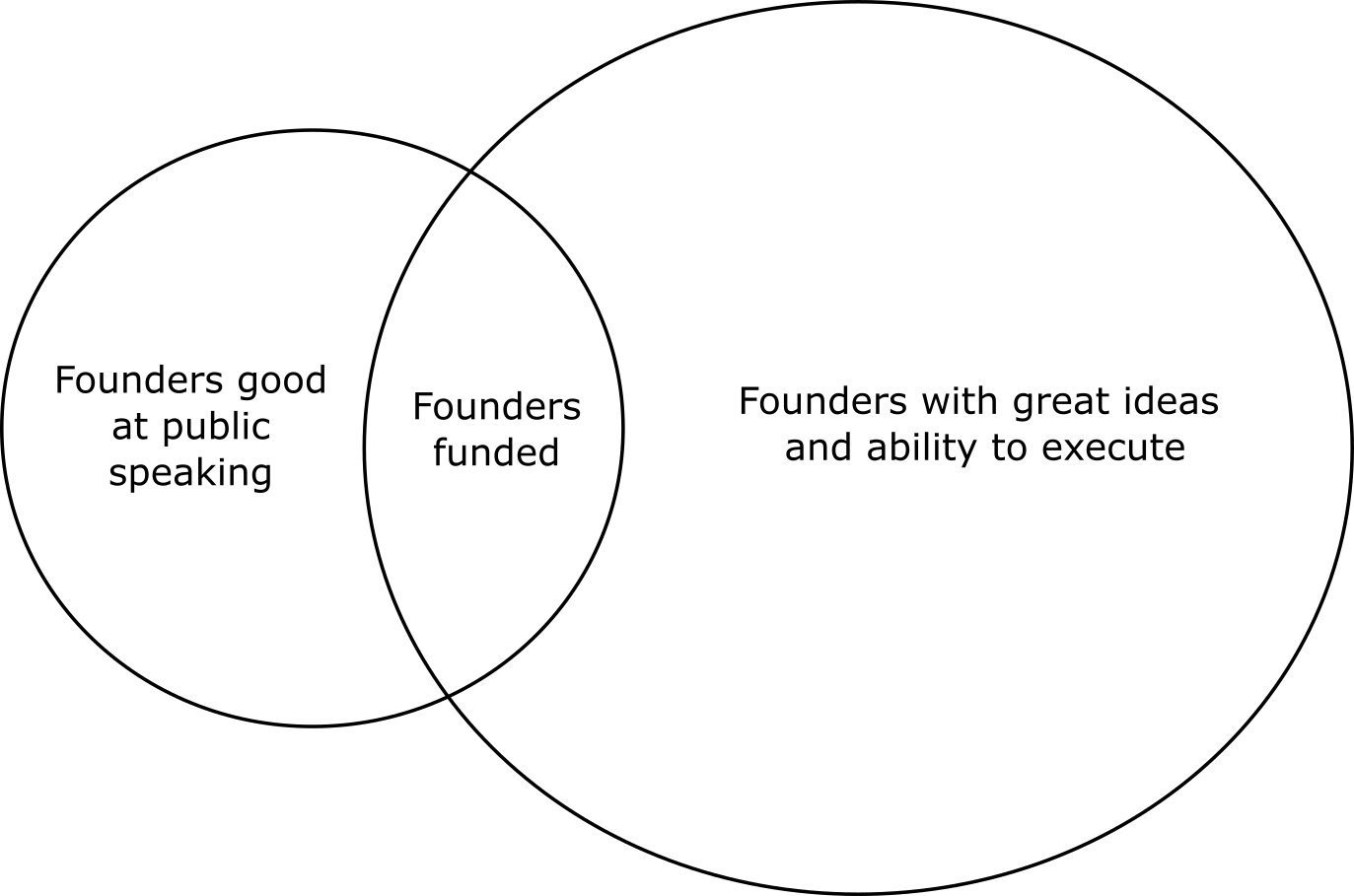

Entrepreneurs come from everywhere. Any background, geography, ethnicity, upbringing, or belief system. They are outliers, taking risks to solve big problems.Entrepreneurialism and potential are equally distributed, but venture capital is not. We want outlier investors to invest in outlier entrepreneurs.

What stage to do you invest in?

We invest in pre-seed and seed stage startups. The earlier the better! We're a prototype fund, so we find ourselves at the earliest stages where founders have an idea and a demand, and need to cross the gap, focusing on startups that can prototype their invention cheaply (ideally <£100K)

How do you support founders?

Informed by decades of success (and frustrations) with university spin outs we provide in-house support to meet the needs of deep tech founders, changing our portfolios trajectoryCapital - Pre-seed capital to prove your prototype, validate your thesis, and bridge the gap between idea and investors.Portfolio discounts - We've hustled to develop a package of portfolio benefits specifically for our science based portfolio. Beyond the usual discounted WeWork space, we provide discounted rapid prototyping, gene synthesis, branding, PR and other useful perksWriting Start-Up Memos: We write the investment memos of start-ups we love, in return for the opportunity to invest. These memos can be shared to accelerate the funding journey. Much more powerful than a deck, these create a narrative in simple 1 pager which drives more meaningful investor conversations.

Where are you based?

Minimum Viable Fund is based in Edinburgh, Boston and London, but we live all over the place.

Minimum Viable Fund is a first-of-its-kind, thesis-driven venture community providing first-money to deep technology founders backed by our community of emerging angels and operators.We invest in the earliest stages of deep tech, helping them build their product, tell their stories and smooth the rough edges along the path to scale.VCs expect scientific CEOs to be PhDs (and usually MBAs too).That made sense for the classic biopharma company, where most of the risk is in fundraising and regulatory.

That made sense for the classic biopharma company, where most of the risk is in fundraising and regulatory.But the next generation of biotech startups will operate more like software companies.

Their scientific breakthroughs often come from a spark of inspiration, not their education.Many biotech founders start with a mission (e.g. reversing climate change) and then find the science that solves that problem.

1. Venture Incubators (e.g. Flagship Pioneering - $14B AUM): VCs who create startups “in-house”, choose the ideas, and license or build the technology themselves.

2. Institutional VC Funds (e.g. OrbiMed - $21B AUM, NEA - $25B AUM): VCs who invest in the biggest biotech Series A, B, and C+ rounds.

Right now, there are two dominant models in biotech VC ( Both of these funding models assume that biotech startups need $10M+ to launch and $100M+ to get to market)

Minimum Viable Fund invests in the earliest stages of deep tech, helps them build their product, tell their stories and smooths the rough edgesUniversities are the walled gardens for innovation in deeptech, while the ability to do science remotely/cheaper/in a garage gets easier and easier. Scrappy and deeply technical founders might be able to validate their tech in-house, but most foundersWe provide a standardised parts toolkit and programme for biotechnology and synthetic biology, and fund prototype development using heavily discounted partnerships which support deep biologically driven innovations

Why Story Telling?

People respond to stories. A good story can attract customers, fans, employees, and investors.It can be the difference between treading water in the market, or making waves.Even deep techs customers are human, and too many early stage tech companies neglect

the value of positioning and story telling - something that consumer brands rarely fail

to pay attention to.Stories also clarify thinking. They help founders identify with their longer term vision,

and drive the big strategy questions which every company faces.

Why So Early?

The earliest stages of technology validation, bringing the idea from an academic

experiment to a commercially ready tool, or taking a brilliant idea from doodle to

reality, is predominantely funded by Innovate UK and other grant bodiesThis is slow, cyclical, and inherently low riskBy being the first port of call for emerging deep tech, we catch sight of the new waves

earlier.

OUR VISION

The future will be written by builders. The biggest questions facing humanity require invention, not incremental change. We need individuals who force the boundaries of what is possible into retreat.At MVF we believe in scientific founders.Scientific founders need a special type of partner. They need someone who can see their potential before the polish, and who wants to join them on the outer edges of what’s possible.A leading deep technology networkMinimum Fund is a pre-seed and seed VC fund. We partner with scientific founders at the earliest stage and give them the support they need to scale.We are highly involved in helping founders raise future rounds, and allow them to tap into a network of high-quality capital.We invest across sectors and focus on AI, Deep Tech, and Life Science. We back businesses led by founders who are domain experts in their field

I’ve been part of a few biotech startups and supported the spin out of even moreIt’s the same story almost every time. The valuations are low, the expectations and milestones are high, and the cycles are slow. Founders have to raise high sums to meet these expectations and de-risk sufficiently for the next rounds, losing equity or taking too little money, creating a valley between seed and Series A.The data backs this up:Ref 1Ref 2Ref 3Biotech, and deep tech more broadly, moves in steps that don’t fit neatly into pre-seed and seed, which is why they end up diluted or underfunded, but very rarely neither, at the point they look for Series A. We’re still running on a pharma/therapuetic model or SaaS VC model binary.Born on the back of low-code tools, APIs, and framework providers which appeared after the first dot.com crash, SaaS has a venture framework for funding, financial tools to support it, and the advantage of earlier revenue generation that biotech. But fundamentally, biotech is becoming closer and closer to SaaS with the advent on cloud based labs, e-commerce style services and reduced barriers to entry more broadly.Biotech needs faster, smaller, gated, rounds which match the milestones they can feasibly hit while taking advantage of faster and enabling tools, services and platforms to meet these milestones faster and cheaper, keeping risk low and funding in line with the next milestones.MVF is a fund for this, providing first money through to participatory seed, with a hard thesis of how to position for a Series A.It used to be that VCs only wanted to invest in biotech startups run by CEOs with PhDs and MBAs. But times are changing. These days, biotech startups are starting to operate more like software companies. A lot of the breakthroughs in biotech come from founders who have a mission they're passionate about and then find the science to solve it.YC is one of the VC firms that's ahead of this trend. They invest in more biotech startups than any other firm. But more angels and VCs need to start investing in pre-YC biotech startups run by young, passionate founders, because these are the types of startups that have the potential to make huge returns in the next decade.Biotech is already the second-largest sector for VC funding, after software. But with software companies starting to reach market saturation, biotech has even more potential to grow in the next decade. We're still in the early stages of "Biotech 1.0."More angels and VCs should be writing smaller checks to biotech startups earlier on, but where there is not a legacy of biotechnology businesses investors are generally put-off by the arcane language, opaque milestones and frequently regulated markets. We also need to see biotech startups operating more like YC companies. The YC fundraising model requires founders to hit more milestones faster, so they can raise money more frequently on better terms. This helps biotech founders keep control of their companies and focuses startups on consistently delivering results.By breaking the first funding round into multiple stages, we can fund more startups and create a founder-friendly ecosystem. We need what I like to call "high resolution fundraising" for biotech. First, an angel round of £50-100k or more to start the company, then pre-seed of £250k+ for prototypes, seed of £1M+ or more for scaling to production, and finally, series A of £5M+ to ramp up capacity or take on a global market.Right now there are two main models for biotech VC funding. There's the "venture incubator" model, where VC firms create startups in-house and choose the ideas and technology themselves. And then there's the "institutional VC fund" model, where firms invest in the biggest biotech rounds, like Series A, B, and C+. Both of these models assume that biotech startups need millions of dollars just to get started and even more to get to market.The problem for start-ups outside of Silicon Valley, Kendall Square and the Golden Triangle is that there just aren't enough pre-seed and seed funds writing £50k to £250k checks for biotech startups. This is forcing scientific founders to rely on time-consuming academic and government grants for their first £10k to £1M+ in funding.Here's the thing, there's a funding gap for pre-seed scientific startups. Over 75% of all life sciences funding is distributed via academic and/or government grants. Another 20% or more, around $15 billion per year (USA), is invested by institutional VCs, private equity firms, and corporations. That leaves less than $3 billion per year in seed funding, less than 5%, for all biotech and medtech startups combined. The picture is the same with Innovate UK, with the UK highly reliant on government funding to de-risk businesses enough to justify investmentBut biotech startups can now create working prototypes for way less than a million dollars, sometimes even less than a hundred thousand dollars. The discovery phase of biotech startups has never been cheaper.

Costs: 📈Science is becoming more affordable. The cost of genomic sequencing has been decreasing at an even faster rate than Moore's Law for over a decade. Additionally, the cost of cell programming is also decreasing rapidly.This means that biology is becoming more programmable. With the help of AI and ML tools, scientists are able to discover and test more solutions entirely in silico.

Speed: 📈Science is becoming faster. In 2020, we had a breakthrough moment in biotech. Scientists were able to go from discovering a novel coronavirus to fully sequencing the virus and designing the first COVID vaccine in just four days. CRISPR moved from discovery to the first human dose in just three years (2013-2016). Zinc Finger nucleases (ZFNs) did the same in eight years (2002-2010). Prime and Base editing are expected to be even more efficient than CRISPR in human dosing by 2025.

Regulations: 📈VCs now have the opportunity to get the benefits of biotech without the costs of pharma. Biotech startups with simple paths to prototypes and low regulatory burden can demonstrate their technology for less than $100K (compared to $4M for pharma Phase I) and get to market for less than $100M (compared to $2B for pharma GTM).Regulatory institutions are also creating special pathways for breakthrough technologies. New emergency use authorization (EUA) and breakthrough therapy pathways at the FDA are expediting the development of new treatments.

Opportunity: 📈Invest in promising scientific startups that are early. New biotech and deep tech founders need support in dropping out, spinning out, and starting up. More pre-seed VC funds should focus on this sector and stage. (See: Minimum Viable Fund)Micro VC funds should focus on non-regulated biotech startups. While it's often assumed that biotech startups will require hundreds of millions of dollars in funding to be successful due to FDA regulations, many biotech startups operate in non-regulated fields such as materials science that don't have these regulatory risks or costs, they need support in science, storytelling and market entry to scale.

The Fund

An early stage pre-seed fund for deep tech ventures focused on synthetic biology, biotechnology, green tech and clean tech

A prototype friendly, first-money fund for founders inside and outside the academic ecosystem, catalysed by the lowering barriers to innovation in these sectors, much like the low-code revolution in software has opened up the door to non-specalistists across the sector

Providing capital, tools and resources for biotech, synthetic biology, and biology enabled technology using the “bootstrap biotech” model

We provide a standardised parts toolkit and programme for biotechnology and synthetic biology, and prototype development using discounted partnerships and scale up partners

Investment beyond the hubs through a “spin-in” friendly programme, redressing the university equity balance through partnerships with regional centers of biotech innovation

Read more of our writing

Why do we exist?

Biotech startups can now create working prototypes for <£1M, and often <£100k. The discovery phase of biotech startups has never been cheaper.There are not enough biotech pre-seed and seed funds writing £50k-250k checks. This is forcing scientific founders to rely on time-consuming academic and government grants for the first £10k-1M+ in funding.These deep tech ventures require deeper due diligence and have a different profile than the typical tech/SaaS venture.In areas without experienced angels, deep tech diligence is weaker and risk appetite is lowered. This creates a cycle of low valuations, stunted growth and business relocation.In short:

Many angels are interested in biotech/deeptech, but are put off by technical jargon, difficult metrics and typically high capital requirements.

Highly technical and industry experienced founders have little access to investment in risk-averse investor landscapes, while students through to PhDs are well supported by funds and programmes.

Too many tech funds are focused on university derived tech, heating up the market and creating high valuations with too much institutional equity on the cap table.

To improve chances for underrepresented founders and create more dealflow there needs to be a replacement for the traditional "FFF" round, and allow innovation outside of academia

We bring a better fundraising model to biotech. Here are the key steps:`MVF Syndicate: £50-100k+ to start the company.MVF Fund 1: £250k+ to create prototype(s).Seed: £1M+ to scale to production.Series A: £5M+ to ramp up capacity.

The Minimum Viable Fund differentiation

VCs expect scientific CEOs to be PhDs (and usually MBAs too).That made sense for the classic biopharma company, where most of the risk is in fundraising and regulatory.But the next generation of biotech startups will operate more like software companies.Their scientific breakthroughs often come from a spark of inspiration, not their education.Many biotech founders start with a mission (e.g. reversing climate change) and then find the science that solves that problem.Right now, there are two dominant models in biotech VC:1. Venture Incubators (e.g. Flagship Pioneering - $14B AUM): VCs who create startups “in-house”, choose the ideas, and license or build the technology themselves.2. Institutional VC Funds (e.g. OrbiMed - $21B AUM, NEA - $25B AUM): VCs who invest in the biggest biotech Series A, B, and C+ rounds.Both of these funding models assume that biotech startups need $10M+ to launch and $100M+ to get to market.

Speed of deals: Using our experience in vetting early stage technology businesses and the teams deep technical knowledge we can quickly assess companies against our metrics. By knowing what we want (and what we don't want) we can say "no" a lot faster.Founder scouts: We recruit existing founders of businesses we love to act as scouts for us in the belief that they are well connected, highly visible, and knowledgable in their specific niches. We also invite founders of our portfolio to become scouts too.Good founders are always networking, looking for PR opportunities and interacting with other early stage companies.These are natural and honest evangelists for fundsStage: We are at the earliest stage of funding for technology companies meaning we can shape them in a meaningful way, spread our risk, and get in early to the rising starsSpecific support: We provide tailored support and discounted services as a benefit of joining our fund which are specifically designed for early stage technology companies. This combines typical overlooked areas such as PR, marketing, and branding with virtual research services to help founders go further, faster.

Quick statistics

- Speed of deal - 21 days from meeting to funding

- Smaller but impactful cheque sizes - capital plus mentorship and portfolio benefits provides more than just the sum of parts

- Our team and advsiors have collectively reviewed over 300 technology spinouts and early stage tech companies, supporting the raise of over £20M over the past 8 years

- We have a good sense of how to validate a "good" early stage team and idea through extensive experience in the rights and wrongs of the university spin-out sector

- We are 100% operator founders (only 8% of EU VCs have founded or worked in a start-up)

What do we look for specifically?

Clean equity positions (spin-outs may have institutional equity but at a reasonable level. Major equity holders are committed to the business in a tangible way)Clear vision and impact metrics (the founders and team are aligned on the tangible impacts they make and what this will mean for customers. This is the metric they will be held to)Remote friendly and able to scale (in order to be successful outliers it's important founders have no blinkers with regard to where they see opportunity)Resourceful (can the team evidence the ability to function in a low-cash environment by bootstrapping, borrowing, or getting things for free)

A place for emerging and under-represented investors

Investment has a bias problem, and so does science. By commiting small cheques at the earliest stages we are able to form a syndicate with a low mininum commitment allowing us to accept a wider range of backgrounds, wealth, and experience.We have built a digital-first community based on referrals and member perks to make a community of investors looking to make an impact while backing the outsiders.We bring our community into all of our investments, which means many of our members can find themselves as advisors and board members

Our dealflow

We've built a pipeline of deals around providing value to potential founders and collaboration with universities across the UK, North America and Europe:

University Innovations Global Network - 60+ university technology transfer offices and accelerator programmes

MVF Fund I - Venture Pre-Seed Programme

Scouting and memo writing for our favourite start-ups

How we assess opportunities

We don’t believe in pitch decks. We either want to get to know a founder slowly over time, or want long-form answers to the important questions.For LPs and syndicate members we provide transparent due diligence through investment memos and external reviewWe provide opportunities and resources for potential LPs and syndicate members to learn and refine their own investment portfolio

I'm a potential angel

what makes this different?

High conviction: We source and diligence heavily, and assemble full data rooms for every deal. Out of the hundreds of companies looked at each year, less than 10% receive investment.

Decision control: Unlike funds, being part of a syndicate means investors construct their own portfolio.There are also no minimum transactions per year or any other expectations. The only requirements we have are on minimum check size (£5,000 per deal) and syndicate membership fees which cover overheads

Alignment with angels: Our leads invest in every deal, and have often also invested much earlier and at much riskier stages in the same company. We only profit if our syndicate profit, by charging a 20% deal carry and no management fee.

Community

We're a community of founders and operators who wanted to make it as easy as possible to invest in deep tech opportunities. We also recognise it can be hard to start investing which is why we've made our minimum annual investment much lower than many other syndicates.We are inviting a diverse, carefully curated community of new investors to join us. Members have unique, radically transparent access into our investment analysis process, and can invest with us with a minimum commitment of £5,000 per yearWe are intentional in making sure that investors from all walks of life (doctors, lawyers, artists, chefs, tech folks, other traditional industry professions) can find a safe place to learn and invest in deep tech busineses alongside us.

We have 45+ people in this community already and add 10-15 more each quarter. Our community is:46% female

9% underrepresented minorities

32% not in tech

67% live outside of LondonInvestment is a changing landscape and people want more than just a return on capital. That's why we also encourage and support our investors to add value as advisors, mentors and board members to our portfolio when the fit is right.We've fully digitised the investment process, and after joining our community you'll be able to review opportunities with transparent due diligence provided by experts in the field, network with other early stage investors and get access to our syndicate perks designed for the modern investor including

£1120 for a 12 month membership 💸

Minimum annual commitment of £5,000

Next intake starts on 10/13/21. Space is limited!

I'm an LP. How can I invest in MVF 1?

Feel free to drop Chris an email at [email protected] if you're interested in participating in MVF.Through digital solutions to venture management we are able to launch Fund I with a maximum of 249 LPs, allowing us to accept smaller tickets and thereby increasing the range of LP backgrounds we can accommodate, specifically:- Corporate venture arms

- Private angel investors

- Underrepresented and new investors

How does the investment process work?

Done. We'll let you know via email if we're going to proceed.

Note: We'll happily introduce you to other investors that could be suitable if we have to pass

We work for you - let us build your investment memo

Investment is a two way partnership. You trust us with your idea and we trust you with our money. The current dynamic for too many early stage founders is investors in the driving seat.We are shaking this up based on two hypotheses about the world:1) Investors are bifurcating into two kinds (the helpful value-adding type, and the cold hard cash type)2) Pitching is fairly pointless and slows down the overall velocity of fundraising.We think a memo provides an opportunity for founders to articulate themselves, the risks, and the opportunity outside of the restrictions of a PowerPoint slideWant us to write your memo? Reach out here and we'll arrange quick intro call to see if there's a good fit

Do I have to pitch?

Not really. We will ask for a pitch deck if you have one, but there are better signals than a highly rehearsed 10 minute monologue!We appreciate a YC style memo, but given the early stage of many of the business ideas we see, we are flexible to how you best can tell us your story

Or submit an existing grant application from a reputable body i.e. Innovate UK - save us the copy/paste job!

Toolkit

MVF has open-sourced our start-up “goodie bag” of 200+ resources, across marketing and design agencies, labs, product development partners, financial tools, packaging, and more.These resources are curated for early-stage founders and pre-founders.We’ve made this available to encourage more talented entrepreneurs to build, and to help expedite their journey to success.

Portfolio Discounts

Highly technical founders often prefer to focus on tech in the early days - earmarking capital and services streamlines the other components of a businessPartner companies are ready to support, and allow founders to start from Day 1, reducing your time to marketWe've also secured over £120k of discounted services spanning gene synthesis to regulatory consultants including:

Other peoples writing we love

We're shameless in admiting MVF is based on the backs of far smarter, more

eloquent people listed below:

Some quotes....

"VC has ceased to be the funder of the future, and instead has become a funder of features, widgets, irrelevances." Peter Thiel / Founders Fund“Yes, VC is now commodity. Personality and critical thinking skills in an investor remain rare. Lead with vibe.”—Geoff Lewis, Founder at Bedrock Capital, ex Partner at Founders Fund“Life is either a daring adventure or nothing. Security is mostly a superstition. It does not exist in nature.” – Helen Keller“From the perspective of an operations guy, there is a lot of riff-raff in venture capital: posers, herd mentality, technology infatuation, too much education, not enough experience to appreciate what grit and focus it takes to grow a business out of nothing.” - Frank Slootman CEO Snowflake Computing"X doesn't grow on trees" ... biology is so much better at manufacturing than any human-invented tech that we use it as an idiom for free and abundant. if we all do our job well in synthetic biology everything will grow on trees." Jason Kelly Ginko Bioworks CEO

Founders Resources

MVF has open-sourced our start-up “goodie bag” of 200+ resources, across marketing and design agencies, labs, product development partners, financial tools, packaging, and more. These resources are curated for early-stage founders and pre-founders. We’ve made this available to encourage more talented entrepreneurs to build, and to help expedite their journey to success.We are an early-stage investment firm specifically pioneering the intersection of consumer and science.We see our partnership with founders as a mechanism to more directly commercialize technical breakthroughs.We actively invest in:1. Pre-seed & seed rounds - we love to engage early!

2. For science-led, IP-driven, and/or technically defensible companies.👉 Our quick litmus test: if it takes a group of smart engineers, researchers, developers, or scientists 12+ months to hack what you’re doing, it’s a fit.

Founders Resources

Our Goodie Bag covers 200+ resources across 5 tables (with specialties listed in toggle down):Table 1: Labs & Development PartnersSpecialties: Biotech, Fermentation, Lab Membership, Funding, Advisors, Design & Development, Consulting, Cultured Cell, Food & Beverage, Personal Care & Beauty, Engineering, Equipment Procurement, Bio-Fuels, Venture Formation, Engineering, Corporate Partnerships, and more.Table 2: Marketing, Design & Growth AgenciesSpecialties: PR Agency, Deck Design, Growth, Branding & Identity, Data Analytics, Creative Tools, Websites, Video Agency, SEO, SEM, Brand Partnerships, Influencers and Affiliate, GTM, Cold Outreach Campaigns, Digital Marketing, Freelance, Graphic Design, Consumer Insights, and more.Table 3: HR & Business DevelopmentSpecialties: Team Hiring, ESG, Investor Relations, Employee Benefits/HR, Background Checks, FDA Consulting, Trademarking, Research, Note-Taking and more.Table 4: Finance, Accounting, FundingSpecialties: R&D Tax Credits, Working Capital, Bookkeeping, Funding, Grant Submission Support, and more.Table 5: Packaging

MVF is the birthplace of the great companies of tomorrow.We are making it easier for non-scientific founders (and technical founders of course) to start biotech companies

The idea here is that, while the tech world has some tried-and-tested corridors to feed the tech and startup ecosystem — Silicon Valley, certain universities, and previously holding an important role at another successful tech company being three of the most stereotypical and leaned-on of these — the growth and increasing decentralization of that ecosystem is creating new opportunities to find talent, and for talent, wherever it may be located, to take the step from concept to building a company around it.

Bootstrap is a catalyst for outlier founders

Fund I is a free, application based community for 50 incredible bio-focused soon-to-be-founders who want to bring innovation from their sketches to the world.

MVF works with emerging founders who leverage life sciences to transform industriesThere is no ‘programme’ - we are not prescriptive around founders having to attend classes - we are looking for self-motivated people who can identify gaps in their knowledge and pro-actively move to address those through insight and guidance from our network. This means we are a great fit for smart, ambitious people who are looking for a peer group as opposed to a boss or additional set of obligations.Our six-month venture model turns PhD students anyone into deeptech venture scientists

Why?- There are many funding options for founders building within a university, but not nearly enough tools to catalyse the talent pool beyond the laboratory

- Industry experts may have the experience and insights that academia have missed

- The revolutions of biotech-as-a-service, cloud computing, and open-source biotech make it easy for non-technical founders to validate their idea (with a little bit of help of course)

How?- Access to a £50,000 ASA and £50,000 of discounted services and support to validate your concept relevent to deeptech and biotech founders

- Access to the Bootstrap Biotech Toolkit

- Support in planning experimental design, validation, and pathway to commercialisation

- Programme of customer discovery to validate the idea and de-risk the concept for future investors

- Access to scientific experts and founders with the option to "spin-in" and collaborate with Universities to take your idea forward

Bootstrap Biotech Toolkit

250,000 antibodies ready to order

20,000 known genes as "BioBricks" to construct new organisms

IGEM style “Lego Bricks” and various cell lines for transformation and expression

Access to biohacking laboratories across the UK

Guided experimental design and support

The ODIN designed Genetic Engineering Lab Kit

Discounts with Synthego, Protolabs, Transcriptic and others

Scale-up support from IBIOC, Bioinnovation Hub Abersytwth and SynbioCITE

Industry connections across our sectoral interests

Our ecosystem

We support our founders by proactively creating industry ecosystem pathways that include scale up facilities, pilot partners, academics, entrepreneurs and other industry leaders in order to make the process of venture creation as seamless as possible.

Together with our network of LPs, angels and advisors, we work closely with entrepreneurs to help them build their company from idea to commercial-scale – whether it’s about validating your technology on the lab bench, forming strategic collaborations, building customer success functions or telling your story and getting you in the headlines.

Biorenewables Development Center

Global BioFoundries Aliiance

IBIOC